Over the tenure of our firm, our clients have been raising the question whether index funds in their allocation of investable dollars are a positive or a negative in their impacts to capital markets, and then ultimately the returns they or their end beneficiaries receive from them. Most recently, The Big Short's Michael Burry made the point that "Index Funds are like Subprime CDO's". As many of our clients have expressed whether Index Funds are causing a market bubble, our investment team at Guidance Point thought it would be a valuable exercise to compare Michael Burry's statements to available academic evidence and examine whether this position had merit in our view.

Price Discovery

According to Mr. Burry, “Central banks and Basel III have more or less removed price discovery from the credit markets, meaning risk does not have an accurate pricing mechanism in interest rates anymore. And now passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies -- these do not require the security-level analysis that is required for true price discovery."

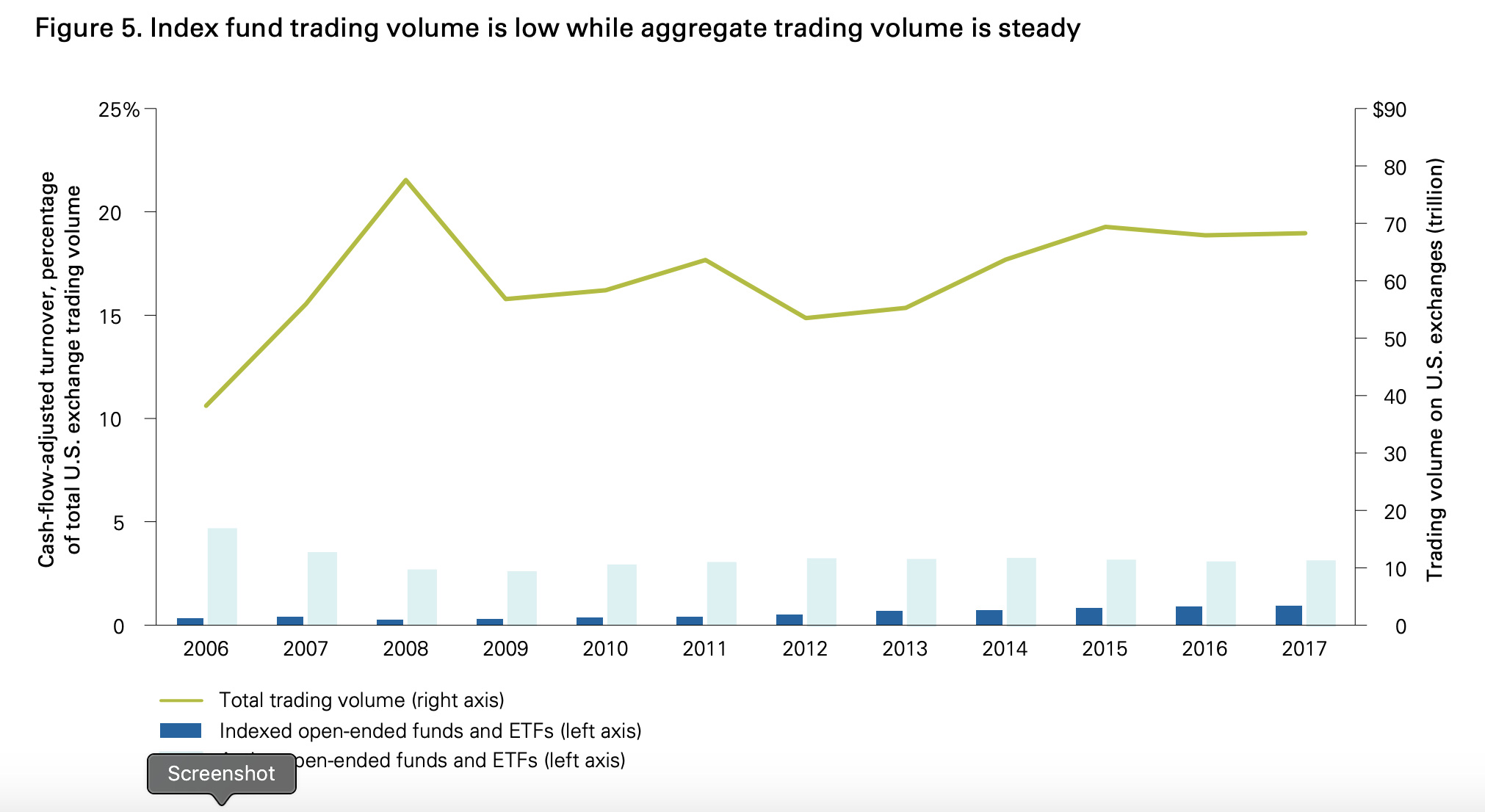

Vanguard provides a very detailed response to Burry's (and other active managers') assertions with their research note in March 2019, "A drop in the bucket: Indexing's share of U.S. Trading Activity." Index funds, as the quintessential buy-and-hold investment, account for less than 5% of the trading volume on the U.S. stock exchanges. In the March note, Vanguard explains that simply using the turnover rate (which is measured by the lesser of either purchases or sales) of the index fund is misleading as it does not account for net cash flows - differences between purchases and sales in the portfolio. After utilizing this new trading calculation, Vanguard estimates that less than 1% of overall trade volume is impacted by index fund strategies. So indexing is hardly the colossus some make it out to be.

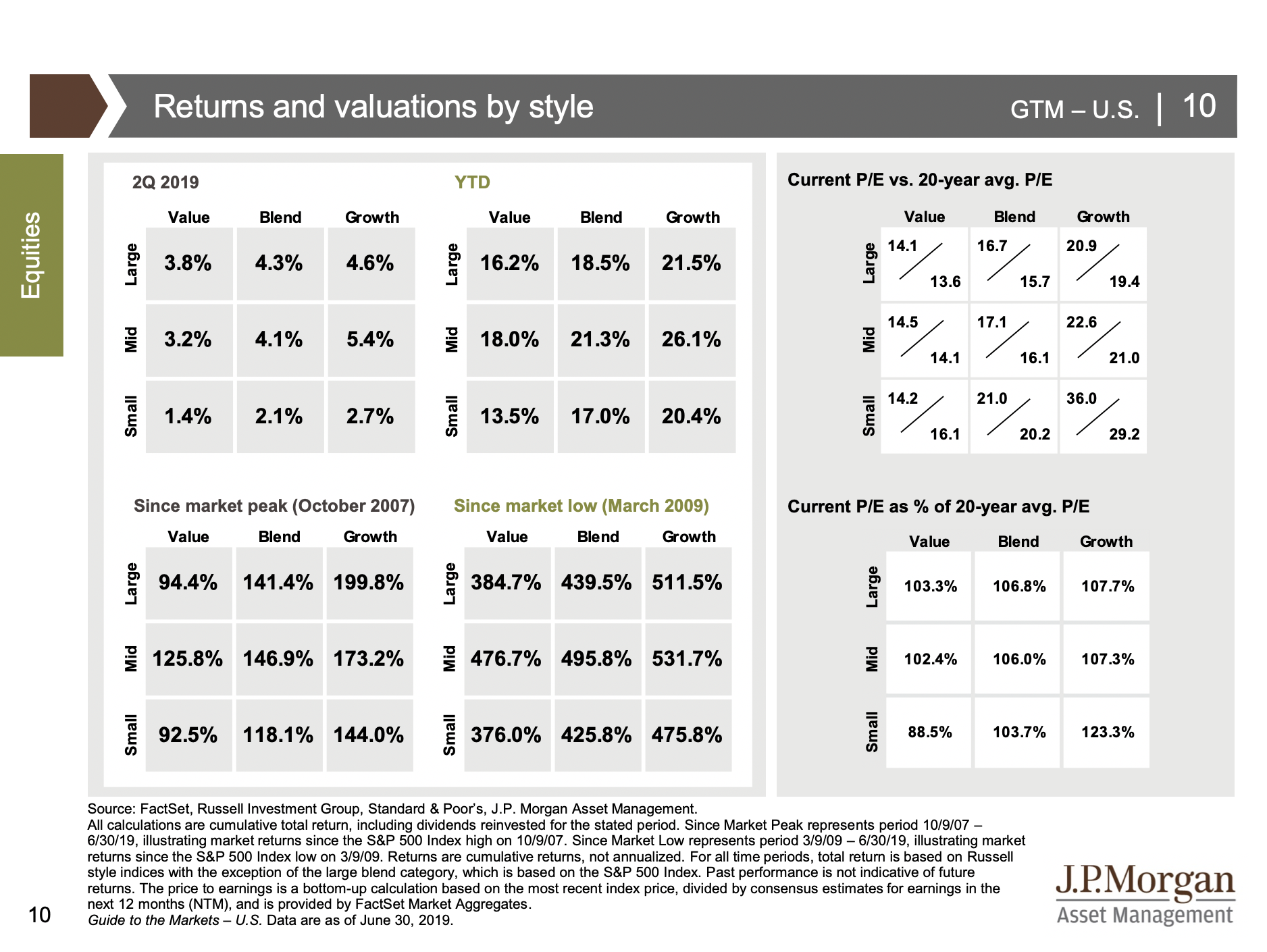

To continue if low trade volume stocks are being influenced by zombie-like buying by index funds, the resulting price inefficiencies would create opportunities for active managers. Using Mr. Burry's premise, fundamentals of these stocks would not reflect the proposed artificial prices created by a supposed index fund buying frenzy. But is that the case? Measuring the price relative to earnings (P/E ratio) created by these companies over time relative to a 20 year historical average, we can use JP Morgan's Guide to the Markets to see if investments, especially small companies as Mr. Burry suggests, are under or over valued relative to historical fundamentals. As you can see the graphic below for this data does not support Mr. Burry's claim (as of 6/30/2019):

Additionally, we would also need to evaluate active managers' abilities to exploit perceived price inefficiencies. Persistence of the active managers' strategies are also necessary to be evaluated to separate skill from simple luck. Our investment team wrote an eBook evaluating this premise and you can review our study here:

For more recent results on the performance of index funds relative to their actively managed counter parts, review SPIVA's website here and DFA's Mutual Fund Landscape evaluation here.

Liquidity Risk

Michael Burry goes on to say, “In the Russell 2000 Index, for instance, the vast majority of stocks are lower volume, lower value-traded stocks. Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those -- 456 stocks -- traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this. The S&P 500 is no different -- the index contains the world’s largest stocks, but still, 266 stocks -- over half -- traded under $150 million today. That sounds like a lot, but trillions of dollars in assets globally are indexed to these stocks. The theater keeps getting more crowded, but the exit door is the same as it always was. All this gets worse as you get into even less liquid equity and bond markets globally.”

Mr. Burry provides anecdotal evidence to why he believes indexing provides too large of an influence on prices. Is indexing A) too big, or influential, in the marketplace, and B) too influential to the pricing of the stocks they hold?, and C) Is the Theater getting more crowded (i.e. are there just more buyers than sellers which is pushing prices skyward a.k.a. a bubble like buying frenzy)?

To answer A), relative to total U.S. equity market capitalization, index funds represent just 15% of assets. Many active managers like to point to the Mutual Fund statistic, where indexing today represents a little less than 40% of U.S. mutual fund assets. As you can see from the two competing statistics, mutual funds do not make up the entirety of the equity investing universe, including Mr. Burry's own Scion Asset Management which is actually not a mutual fund and has historically registered as a Hedge Fund.

In regards to B), being too influential on their positions, investors in index funds are generally buy and hold investors. However during poor performing markets, are investors fleeing these investments and causing panic selling as proposed by Mr. Burry? Again, Vanguard's research note explores this premise. Perhaps the secret culprit is High-frequency trading (HFT). HFT is a significant trend that has been on the rise since the mid-2000s. Avramovich, Lin, and Krishnan (2017) estimate that about 50% of recent stock trading volume in the U.S. is driven by HFT.

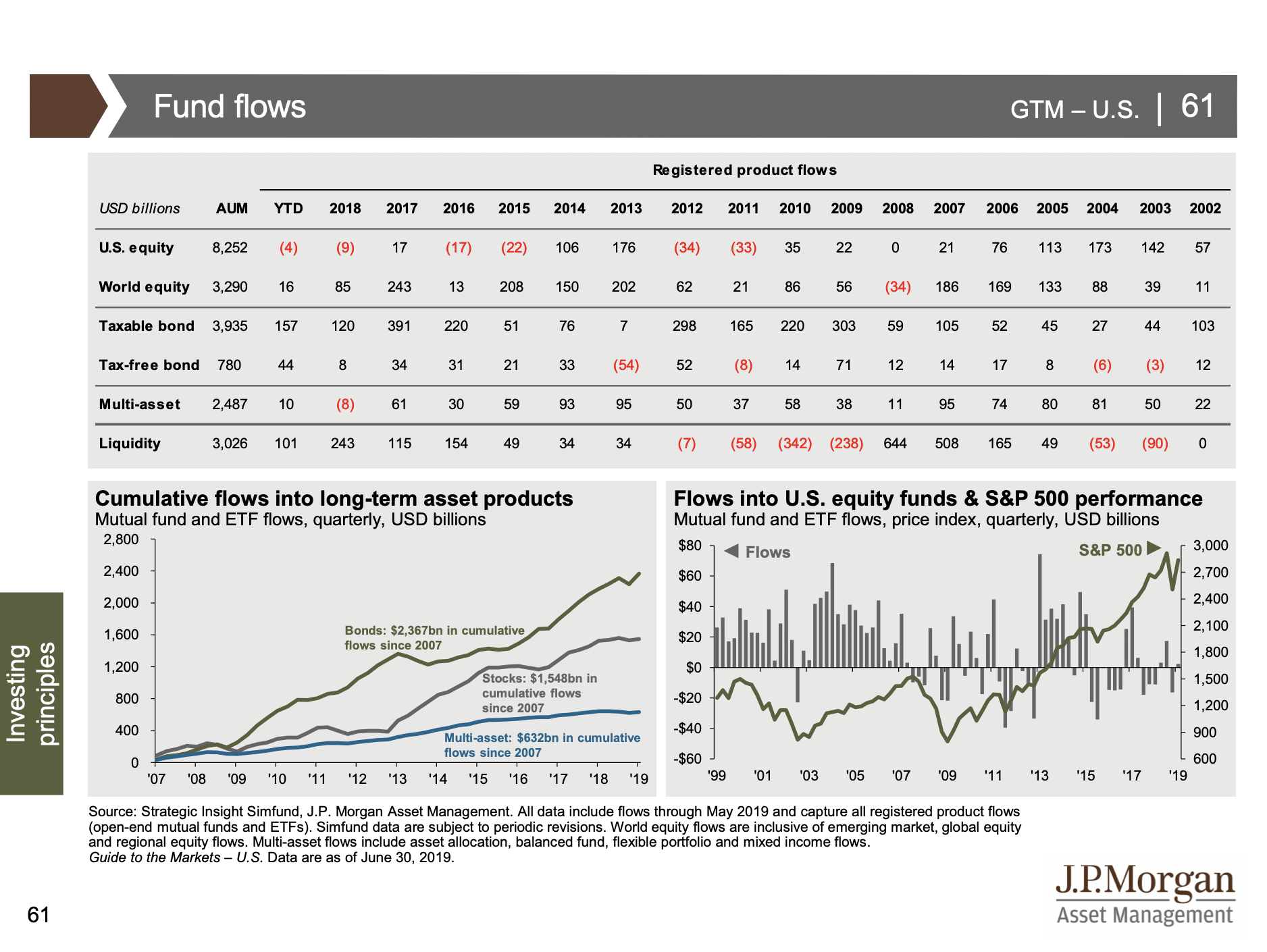

For C) let's look at the net fund flows over time for registered products in the image below, again from JP Morgan's Guide to the Markets.

Interestingly enough, US equity flows have seen fairly neutral flows for much of this bull market. Perhaps this is an echo of investors still skeptical of equities from the aftermath of the financial crisis? Notably any new cash flows to equities have gone to world equity funds where international equity markets have not nearly rallied to the extent of US equity markets. One could argue that any "new" money flows into investment markets have been to taxable bonds and money market funds over this time period.

Presumably if index funds are growing, there is a zero sum that is occurring as dollars are leaving active managers. Perhaps investors are evaluating the net of fees performance of the managers they have hired to manage their money and changing to index funds? If index funds are creating or in the future create inefficiencies in the prices of their securities, this would then favor active management which can then exploit mis-priced securities. In turn, they would have better performance and attract investable dollars away from passively managed funds.

It Won't End Well?

When we hear market predictions calling for sensationalized ends to capital markets, regardless of who they come from, our team tends to be skeptical of the conclusion. Of course, saying that "It Won't End Well" can grab headlines and investors attention or this can be interpreted many ways - Will equity index funds lose money during the next equity bear market? Or does this mean we'll see a repeat financial crisis? Or does this mean this issue will spur the collapse of capital markets?

In our team's careers, we've known a perma-bear or two that perpetually call for bad endings. It's a paradoxical statement to be hyper critical of capital markets while accepting funds from investors and invest on their behalf into said capital markets. Mr. Burry was able to make a name for himself from the book and movie, The Big Short, due to his bet on a highly unregulated and private market that existed around Subprime Collateralized Debt Obligations (CDOs). After examining the evidence to understand Mr. Burry's perspective, we disagree with his statements regarding index funds causing a market bubble.

Other articles you may find useful:

3 Reasons Your Retirement Plan Should Use Index Funds

Top Rookie Mistakes When Evaluating Your 401(k) and 403(b) Target Date Funds