1) Financial Coaching is the next evolution in the Participant Experience

One session we attended was titled "The Evolution of the Investment Lineup Spectrum." It was presented by Franklin Templeton representatives, and they discussed a few impactful points to open the presentation. Robert Cruz from Financial Fitness for Life classified participants by fitting them into one of two categories, "the Hunted versus the Ignored."

One session we attended was titled "The Evolution of the Investment Lineup Spectrum." It was presented by Franklin Templeton representatives, and they discussed a few impactful points to open the presentation. Robert Cruz from Financial Fitness for Life classified participants by fitting them into one of two categories, "the Hunted versus the Ignored."

The 'hunted participant' has an account balance that is attractive to most or all Financial Advisors and has little difficulty getting access to financial advice. The 'ignored participant' is where Robert says we can all do better. Ignored participants are more likely to stay in their 401(k) for longer (potentially for life), but only have access to financial advice through their plan construct.

Robert quoted statistics about Dave Ramsey Financial Wellness tools Financial Peace University (FPU) and SmartDollar. "When 401(k) participants were required to sit down and watch a 10 hour video learning series about retirement, the study reported no change in participant behavior after participation in the series. However, when individualized coaching was applied to a similar control group, the majority of participants reported adapted behavior." Robert believed that the Video Learning tools in the industry (like SmartDollar), while more accessible through technology and cost, are not creating change for the ignored participant. However, coaching tools such as FPU, are having a much more dramatic impact.

2. There are MANY Financial Advisors "dabbling" in the 401(k) Advice business.

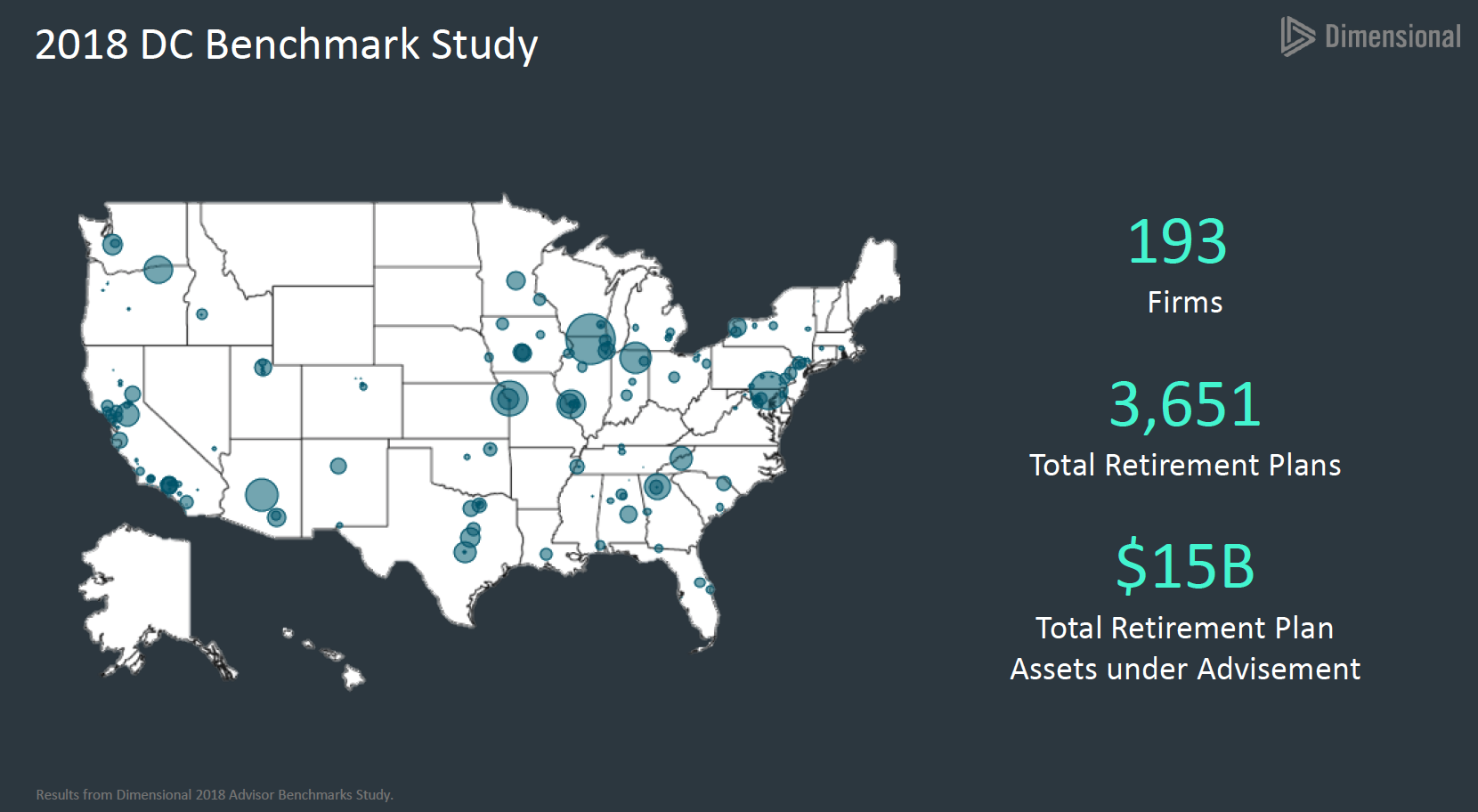

Another breakout session from the fi360 Conference we attended was the "Key Insights from the 2018 Dimensional Advisor Defined Contribution (DC) Benchmarking Study" presented by John Resurrecion, Regional Director for Dimensional Fund Advisors (DFA). John was presenting DFA's DC Benchmark Study. You can see the survey membership below.

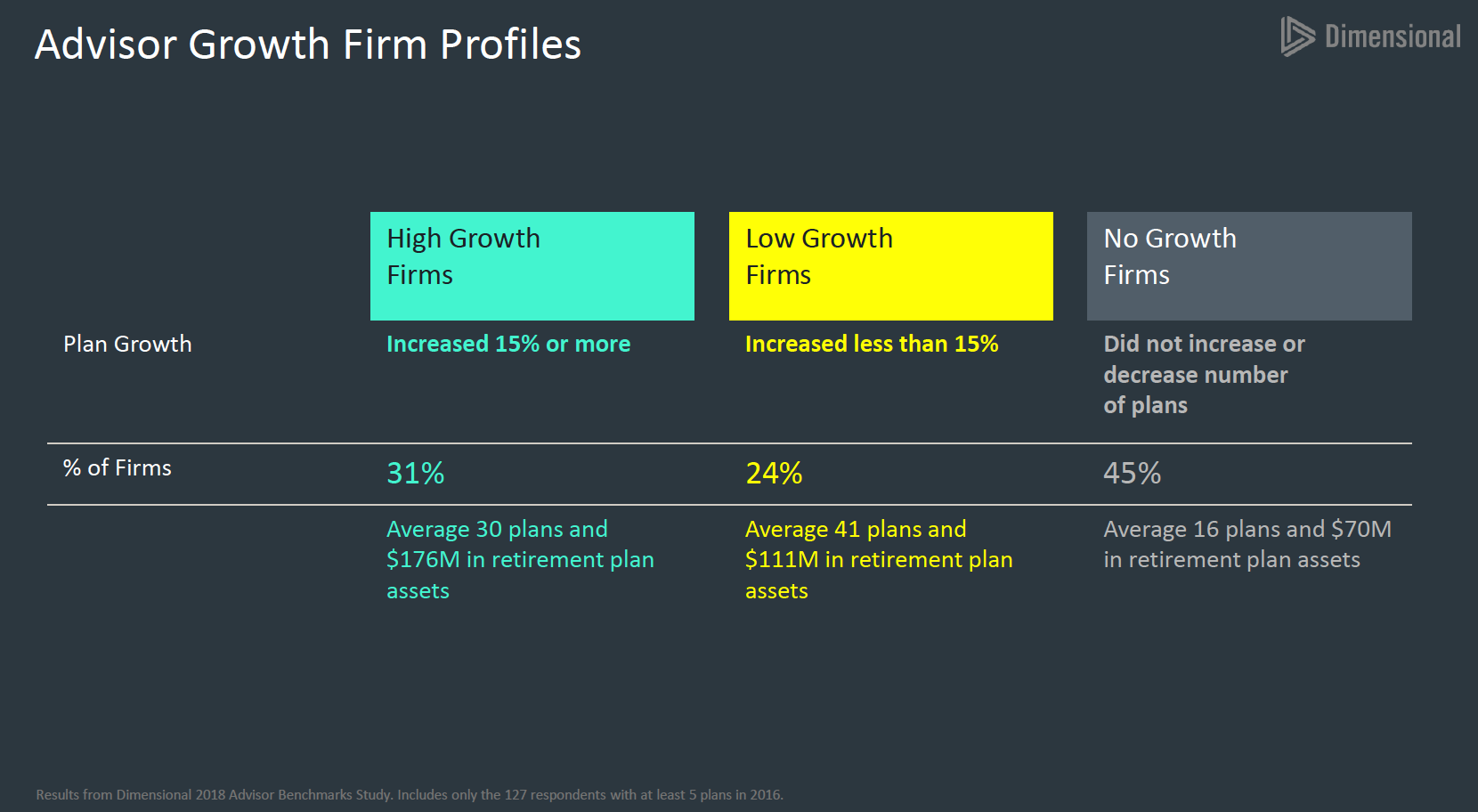

Just doing the quick math here, 193 firms average nearly $77mm in retirement plan assets and have an average of over $4mm in assets for each retirement plan. Our reaction was that the survey seemed to include many smaller retirement plan consultants. We believe the true Retirement Plan Consultant firms usually derive 80-95% of their revenue from retirement plans and generally have over $750mm in plan assets. Our firm itself just crossed the $1 billion range in regards to assets (see our Form ADV Part 2A for official assets listing). DFA broke out the firm profiles below and that verified our thought.

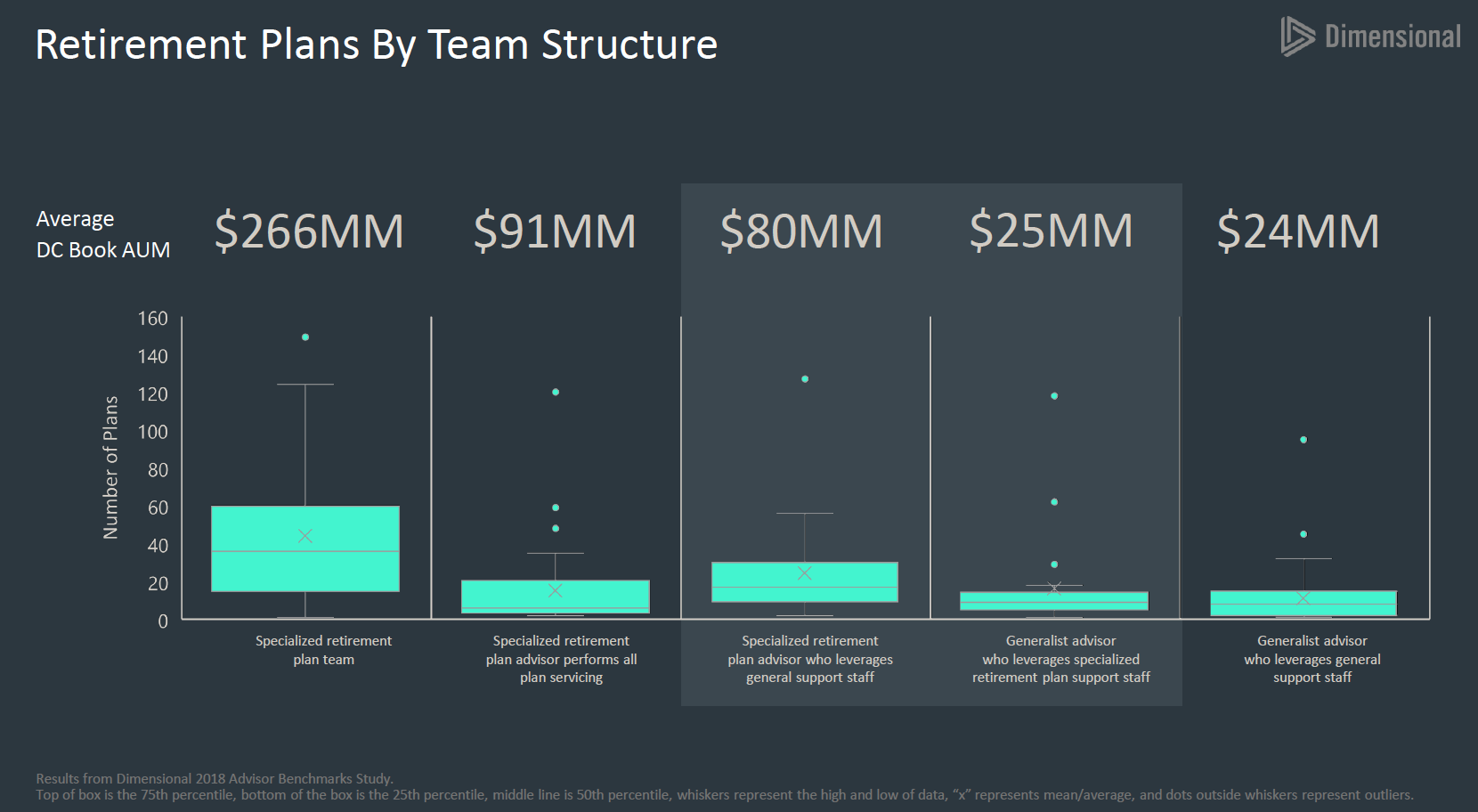

DFA also highlighted not only was the level of assets smaller (in our view), but many advisory firms do not have a team that is fully specialized in their practice around DC retirement plans. Most team structure included a generalist financial advisor and/or generalized support staff.

Anecdotally as we were networking at the fi360 conference, we did find that a specialized team within a larger financial planning firm was the norm structure. Many teams described fitting into this survey sample and struggled with many of the issues described by Mr. Resurrecion. They struggle with not dedicating resources to the line of business and were handed this book of business as it wasn't the highest revenue or margin business line. Thus, our networking found that many advisors were "dabbling" in the 401(k) and 403(b) space and not truly dedicating themselves to see their expertise and business grow.

3. Many retirement plans' automated investments are working to solve the longevity risk of participants, but what about the sequence of return risk?

A third breakout session from the fi360 Conference we really loved was the "Expanding the Framework of Safe Withdrawal Rates" presented by Michael Kitces, Director of Research for Pinnacle Advisory Group and Blogger of Nerd's Eye View. Michael is one of the leading academic researchers in the Financial Planning space, and this was a personal highlight. Michael went through an analysis of why have we used 4% as a rule of thumb safe withdrawal rate. Where did this come from? Has it worked? You can read his entire presentation here, but below are the highlights we took from his talk.

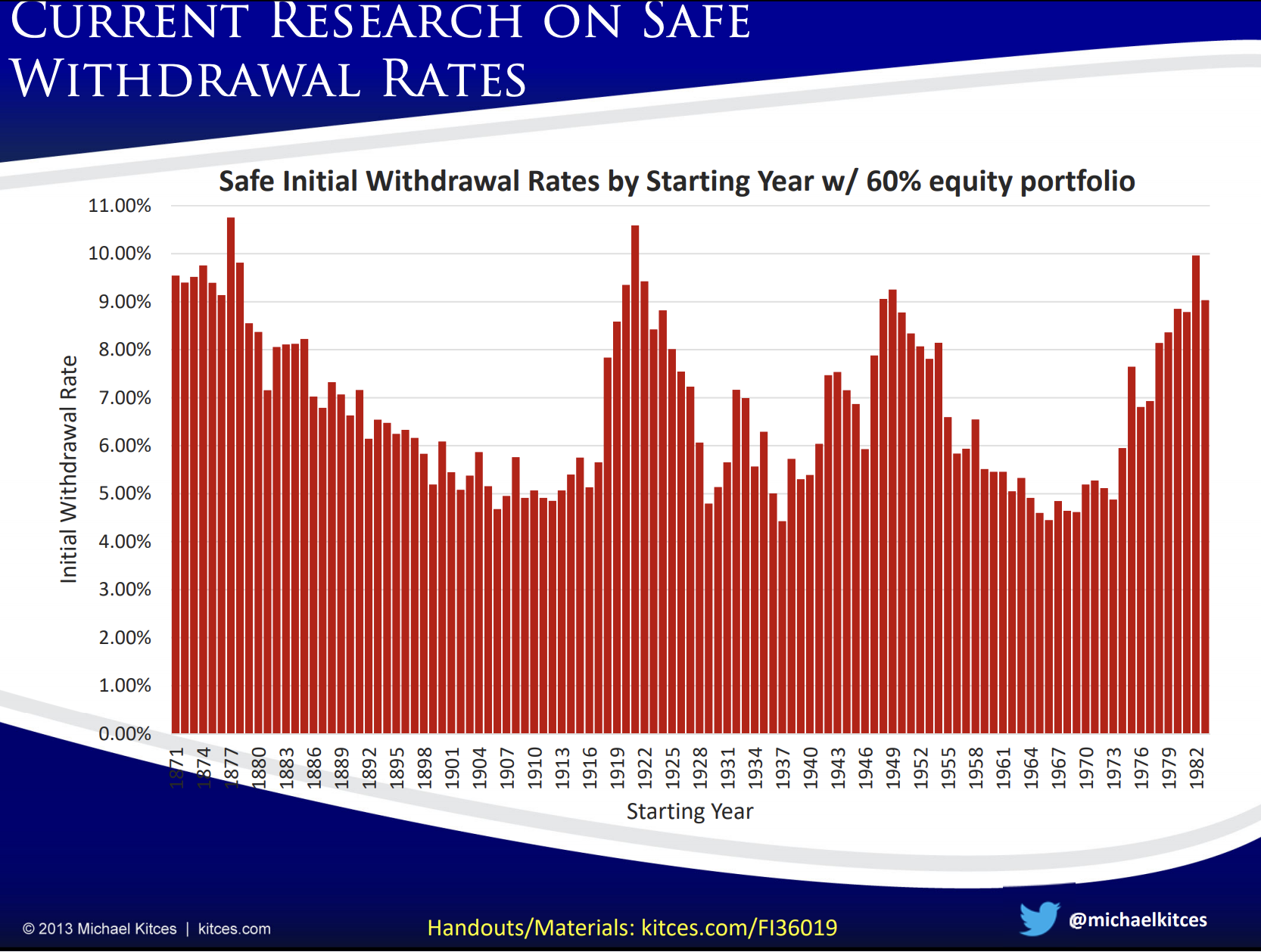

First up was how did we get to a 4% stated Safe Withdrawal Rate (SWR)? It really was as simple as looking at the below chart and finding a 30 year period that sustained an account balance through the worst of periods. Since the average SWR was 6.5%, this wouldn't work since it would mean 50% of retirees would run out of money! 4% was the lowest SWR that saw the highest success rate for a retirees' income lasting 30 years. This meant that even during the Great Depression when the market dropped by 89%, a 4% SWR worked!

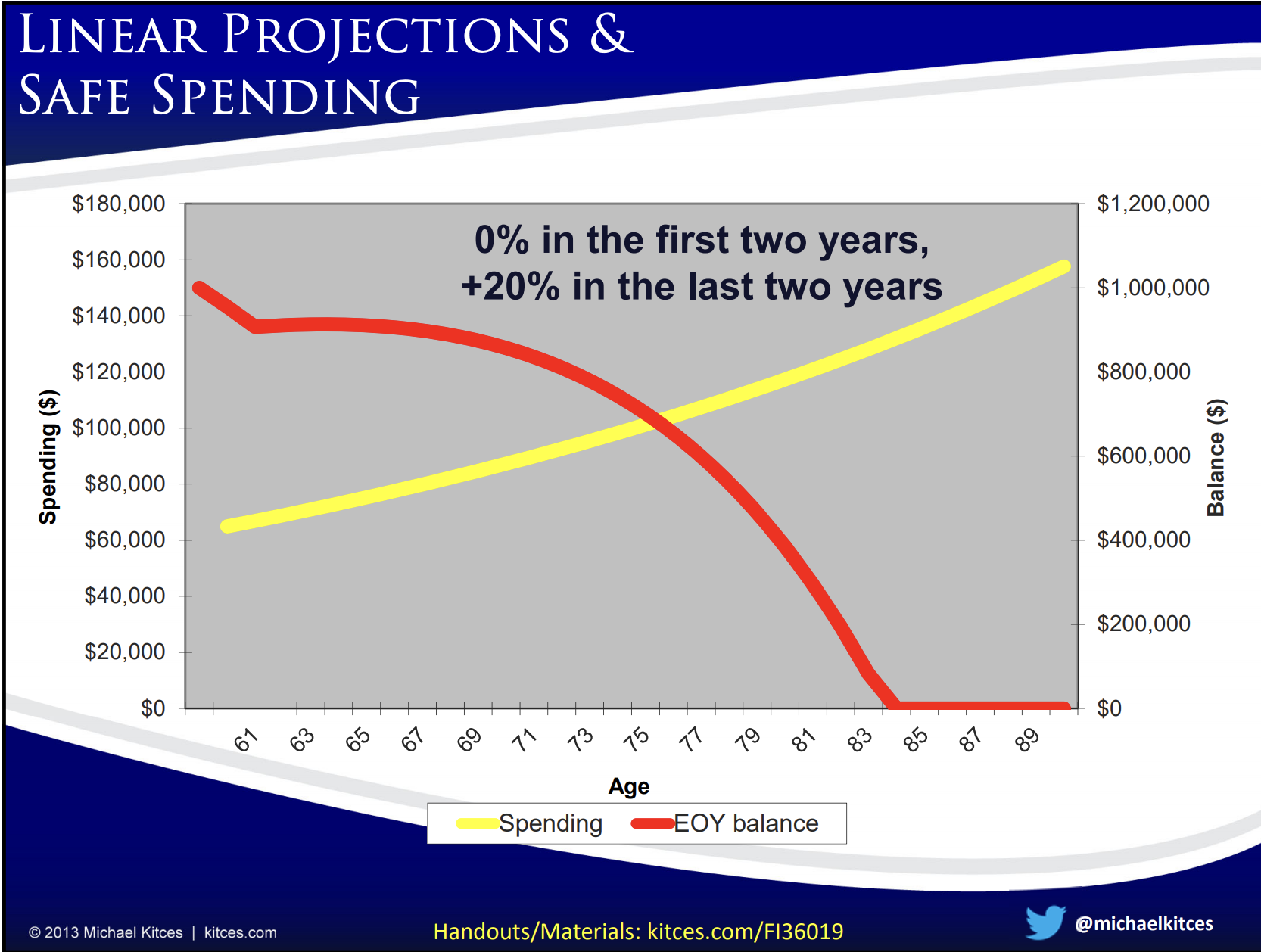

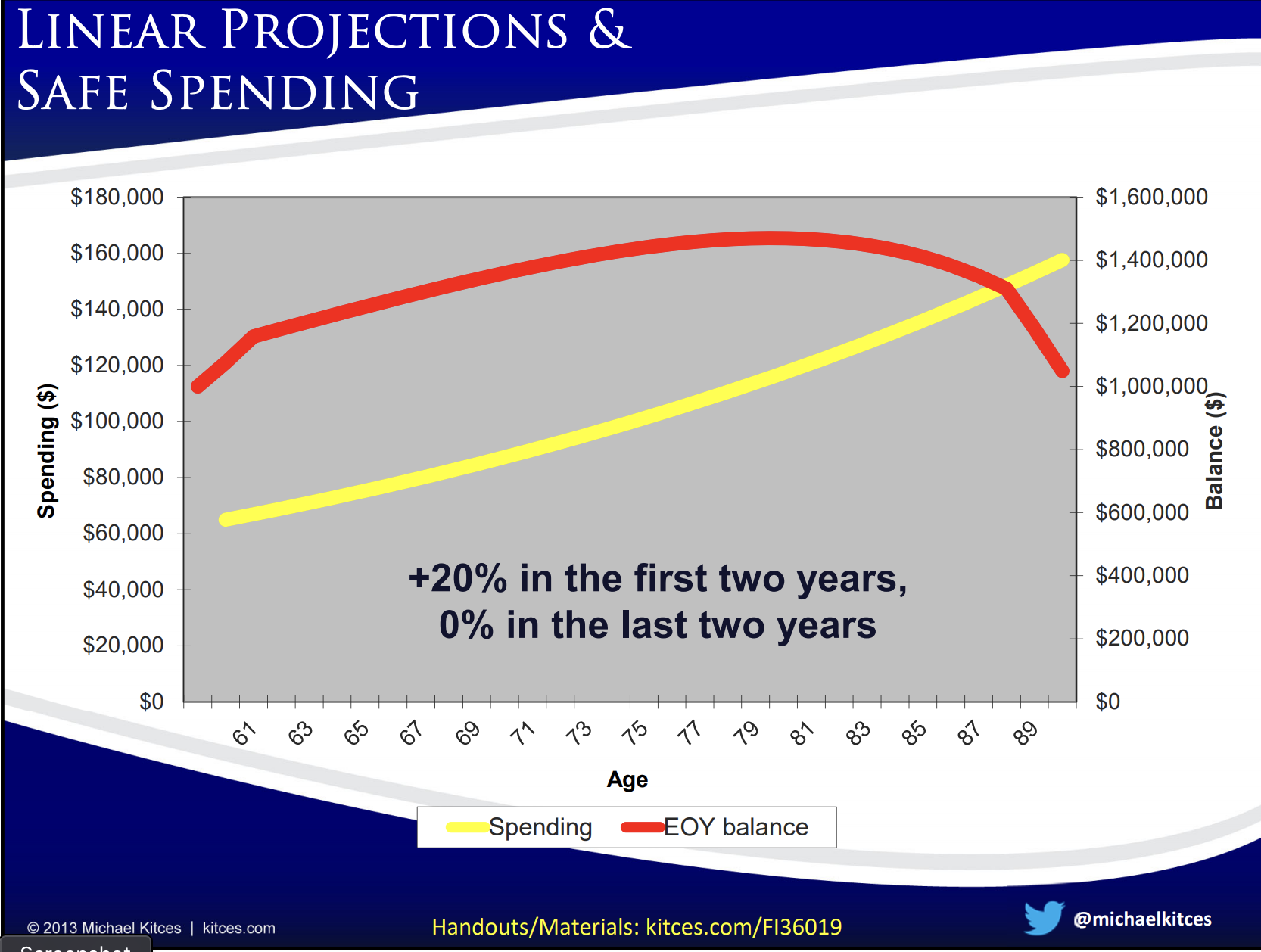

While that was very interesting, the biggest concern that applies to retirement plan sponsors was the impact of return sequencing. In our estimation, many financial plans and target date funds use many straight line assumptions on spending and investment growth, assuming they are the same each and every year. Michael demonstrated the impact on a retirement by keeping an *average* return of stocks at 10%, but in the first two years having 0% growth and the last two years at 20% growth and vice versa. Check out the below:

Starting at a 0% return for two years and having great returns late really impacts the longevity of a retirees portfolio, the retiree runs out of money 6 years too early. Never mind what happens with a negative return in the first formative years of a retirement!

In the opposite scenario, earning a higher than assumed rate of return on the retiree's portfolio grossly over produces relative to the assumed level of spending.

As retirement plan sponsors and fiduciaries, what are our duties here? It seems that this should be a careful consideration when factoring in the "Do It For Me" investments within the retirement plan menu, i.e. Target Date Funds (TDFs) and allocation funds. A consideration when choosing TDFs should be the level of equity risk that is being taken "at" and "in" retirement to avoid a negative return sequence for retirees. If your employees do experience this loss at the most inopportune time, possible consequences may include delayed retirements, higher healthcare costs, and disengaged workers. In our experience, Ron Surz at Target Date Solutions has been the most vocal proponent of protecting against sequence of return risk within plans. A version 2 of Target Date Funds may be one that aims to protect against sequence of return risk and longevity risk concurrently.

4. Look for more disclosure on RIA Revenue to Retirement Plan Sponsors

Lastly, we attended Fred Reish's "Investigations of RIAs for their Service to Plans". Fred spent a lot of time reviewing Department of Labor, FINRA, and Securities and Exchange Commission priorities when examining investment advisors that provide services to retirement plans. The Department of Labor last year completed their "PIC" project, or Plan Investment Compensation. The purpose of the review was to evaluate all direct AND indirect compensation that advisors are receiving from a plan so that plan sponsors can properly assess any conflicts of interests of their advisor and benchmark total compensation to services.

Back to the "dabblers" point on #2, Fred commented that Registered Investment Advisors (RIAs) with the majority of their business in Defined Contribution plans are doing a good job here. Many of the dabblers who do a few plans generally struggle with how they receive compensation and have more indirect compensation. Indirect compensation can mean entertainment from fund companies - theatre tickets, travel, sports tickets, etc., but can also mean services sold to participants (for example, if the retirement plan advisor is also selling life insurance or other products to plan participants). As plan sponsors, it'll be important to get an accurate picture of all revenue streams received by your hired advisor so that you can properly benchmark and monitor their activities.

Conclusion

The 2019 FI360 Conference was a great conference and while mostly attended by investment advisors, fund companies, and recordkeepers, it really is an excellent educational event for decision makers on retirement plans. It provides an immersive three days of fiduciary best practices and thought leadership. Next year is in Austin, and we'd encourage anyone working on retirement plans, especially retirement sponsors, to attend in 2020!