One of the first questions that companies want to know when they call one of our consultants is: "How Much Does a 401k Plan Cost?" This question poses two important realizations to senior managers of companies as they assess 401k fees. 1) If the company is paying the vendor costs on behalf of employees, the fee can grow significantly as more employees are utilizing the benefit and more assets are accumulated in the plan. 2) ERISA law requires employers to follow certain rules in managing a 401(k) plan including: ensuring that fees paid to service providers and other expenses of the plan are reasonable in light of the level and quality of services provided.

Although this is a very difficult question to answer, we'll work below to explain some general pricing guidelines for 401k plans.

The costs of any retirement plan is much like the cost of building a home . There are service providers that are performing very defined functions as the project is being completed: general contracting, electricians, plumbers, etc. Other factors directly influence the cost: How large will the home be in square feet? What kind and quality of appliances are being considered? This is very similar to the exercise that a 401k plan sponsor will undertake in evaluating the overall level of costs associated in supporting their plan and concurrently comparing costs to other like sized 401k plans. What are the steps in getting started?

1. Gather all the Service Provider Contracts related to your plan.

This is not an easy task. Many times the pricing can be buried in contracts or pricing can be situational. If you can't easily locate the applicable charges, don't feel bad by asking each service provider to clearly spell out their fees in addition to onboarding or exit costs. There are generally four categories of service providers that assist in offering your 401(k) plan to your employees.

A) The first party is the Custodian, or the company that is to hold your employees' retirement plan assets in a trust. This party may also be offering Trustee services for your plan as well. Locate the contract for this party along with what services are being provided. Generally, custodians charge a fixed annual fee and some asset based fee that is calculated by the amount of money currently in the plan. Trustee services are generally fixed in cost, as well.

B) The second party is Recordkeeping & Third Party Administration (TPA). Many times in retirement plans these functions may be performed by one entity, but there are times when the functions are split and two entities are providing the services. Also, note that this/these service provider(s) will heavily influence the selection of the custodian. Due to this factor, many service contracts for custodians and recordkeepers / TPAs are combined. Recordkeepers and TPA services have many differing fee structures. Some charge a fixed fee and a per head fee, some add a small asset based fee to their structure, and many only charge an asset based fee.

C) Third up is the Investment Advisor. The investment advisor's overall role is to assist the retirement plan committee's selection of investment options offered to retirement plan participants. It is important to note the services that the advisor is providing here. Are they a 3(21) or 3(38) fiduciary for your plan? Are they not a fiduciary at all? Are they consulting on all retirement plan matters (vendor selection, contract negotiation, fiduciary governance, etc.) or just investments? Do they provide participant education services? Investment advisors fees can be a fixed fee or an asset based fee. Its important to note where their fee originates and whether the advisor is paid from the investments selected.

D) Lastly are the investments in the plan. Unfortunately, the investments and their associated costs are the least scrutinized by the plan sponsor in our experience. Many service providers have sold plans on the premise that the cost of a 401k plan is "FREE" and the company never sees a bill. In this situation, all service providers are paid by an overinflated mutual fund or annuity expense. In this scenario, its also difficult to truly know what cost is associated with which service provider and then impossible to individually negotiate contracts for a better cost. The plan sponsor should be evaluating the expense ratio of each investment and evaluate any payment streams submitted to another service provider. The sponsor should evaluate the investment costs of the plan on a weighted average and a total fee basis.

2) Perform an Independent Fee Benchmark Analysis

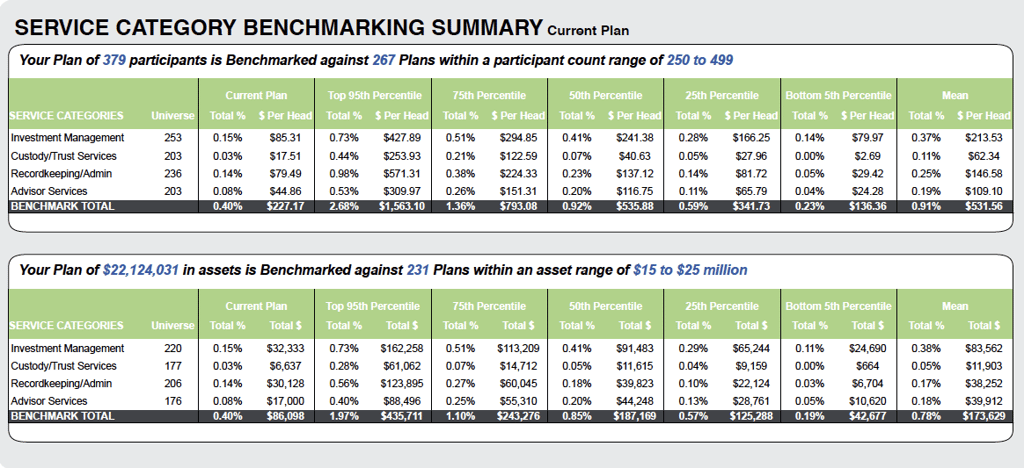

The Department of Labor suggests that the only true way to benchmark your plan fees is to send your retirement plan through a Request For Proposal for vendor services. Unfortunately, this is a laborous process to undertake and not feasible to perform on an annual basis. Its important to know that every year vendor pricing changes, and as your retirement plan assets grow in size, it may meet a size where another vendor may be a better fit, provide better capabilities and technology, and most importantly better pricing. The overall theme on retirement plan costs is that they continue to go down as a percentage of plan assets as plan assets grow. Thus, an annual evaluation is important to undertake for negotiation leverage and protection of your plan fiduciaries. Below is a sample of a 401k fee benchmark.

In the above example, you can see that a 379 participant and $22 million 401k plan is being compared plans with "like" characteristics. Its important to consider the source of the benchmark system, including how dated is the data and the amount of plans in the benchmarking universe. What's very helpful about the above service is that you can see the overall costs of providers by services and where you may be able to improve costs. In the above 401k fee benchmark example, the plan has done a good job in negotiating each service provider so that their overall costs are cheaper than the bottom 25th percentile of all plans in their peer group. This benchmark may not be a judgment on the plans paying in the 75th and 95th percentiles; ERISA law asks that plan fiduciaries evaluate that expenses are reasonable to the level and quality of services provided. If you are in search of help in evaluating your current vendors and their pricing, please visit Guidance Point's The Starting Point service.

We hope this blog post provides you a solid framework you can follow if you're just getting started in evaluating your 401k fees & service providers or if you're concerned about what you may be missing. If you have more questions about your fiduciary duties to your retirement plan, feel free to download our free Fiduciary Responsibility Guide eBook below.

Other blog posts you may enjoy:

Improving Plan Operation, Cost, & Investment Structure: A 401(k) Case Study

The 3 Questions an ERISA Compliance Checklist Will Answer

Guidance Point Retirement Services named to Pensions & Investments 2016 Top Pension Consultants List